Managing operational risk is one of the key parts of building a successful as well as robust business. Operational risks include people risk, process risk, financial risk, systems risk, external events risk, legal and compliance risk etc. This may arise in any part of the organization by anyone irrespective of their role in the organization.

Once we accept the risk is part of business operations, we need to manage the risk effectively. Managing risks include identifying the possible sources of risks, assessing them effectively, their nature, their likelihood of occurrences as well as potential damage etc.,) and defining and implementing effective solutions to manage the risks.

For example, we know the regulatory requirement of submitting certain reports by certain days, we need to assign this work to an individual and monitor it. If it is software development companies, we have testers as well as internal auditors to ensure that the delivery has all requirements and functions well to avoid any potential business or reputational risks.

Most of the global and reputed organizations have defined centralized risk framework and implemented them at local level by accommodating few local requirements. There are several risk frameworks based on ISO 27005, ISO 31000, COSO ERM, or a hybrid. This risk management framework manages potential risks as a part of corporate policy and give oversight to operations. This oversight can be achieved by automating risk management process and workflows, monitoring the new and existing compliance requirements, periodic risk reporting mechanism, auditing the process etc.,

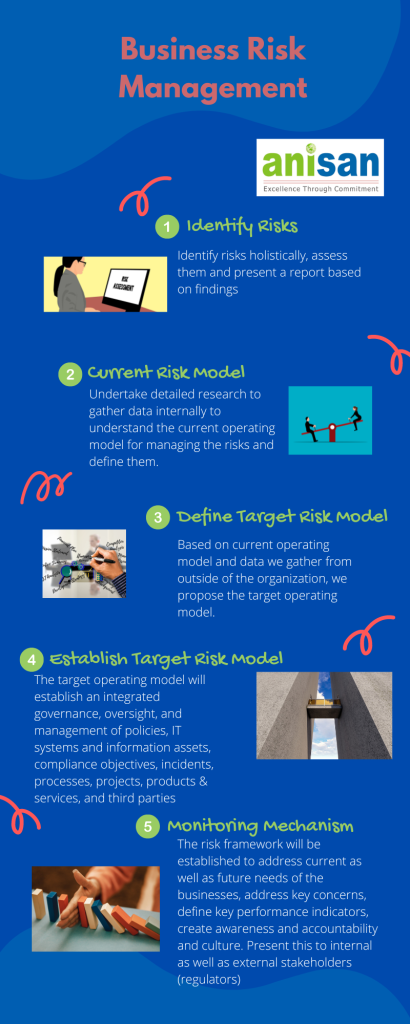

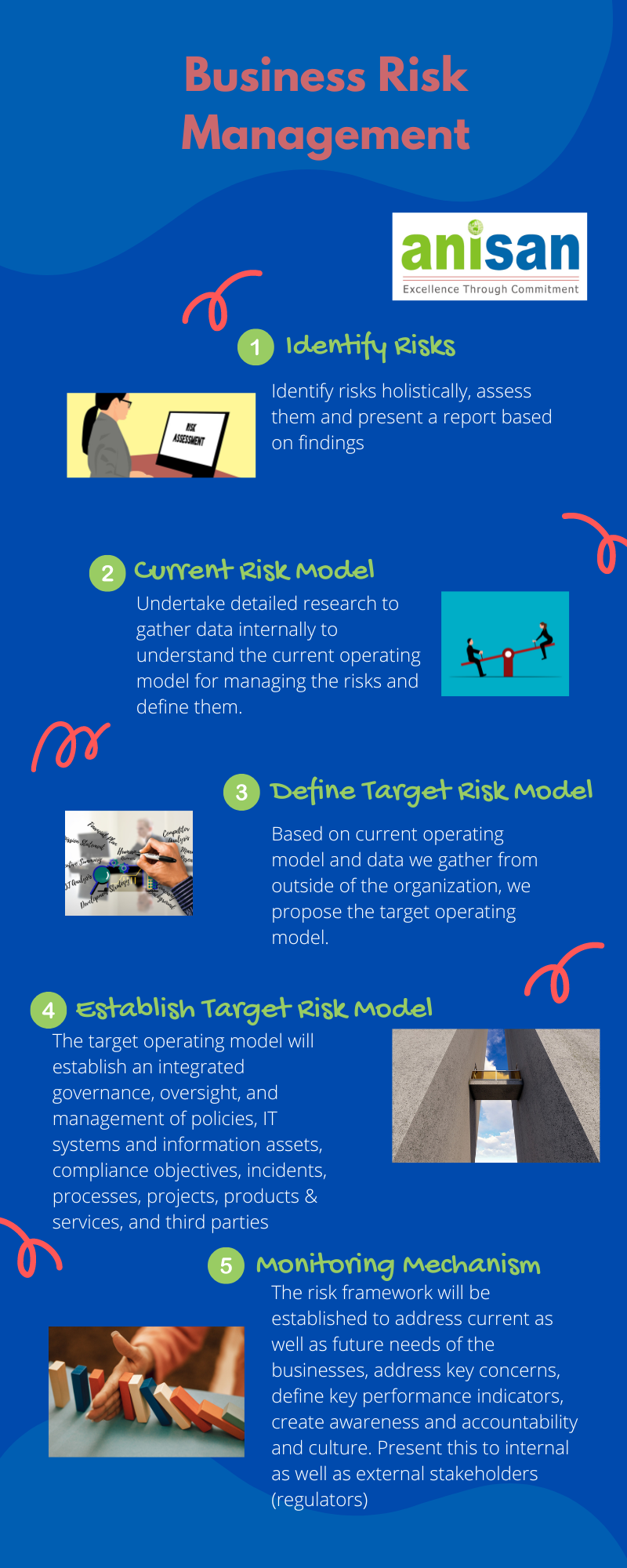

We offer corporate risks services as below:

- Identify risks holistically, assess them and present a report based on findings.

- Undertake detailed research to gather data internally to understand the current operating model for managing the risks and define them.

- Based on current operating model and data we gather from outside of the organization, we propose the target operating model. The target operating model will establish an integrated governance, oversight, and management of policies, IT systems and information assets, compliance objectives, incidents, processes, projects, products & services, and third parties

- The risk framework will be established to address current as well as future needs of the businesses, address key concerns, define key performance indicators, create awareness and accountability and culture. Present this to internal as well as external stakeholders (regulators)